Will we have two grains markets in Australia this season? – Rabobank

As of early April, there are very different realities when it comes to soil moisture in the east and the west of Australia.

RaboResearch grain and oilseeds analyst Vitor Pistoia said the former, in a general sense, has average to good levels of soil moisture while the latter is experiencing challenging seasonal conditions and soil moisture in Western Australia overall is low.

Mr Pistoia said large swathes of WA’s wheatbelt have received less than 25 millimetres of rain since late 2023 and for South Australia, the summer has also been tough.

“This difference in soil moisture conditions on the two sides of the country might have impacts beyond the usual risk-reward analysis of choosing to grow more demanding crops, such as canola over wheat.

“It may mean we could see two different grain markets developing on each side of the country in the year ahead if the rainfall outlook does not improve in the west in coming weeks,” he said.

Mr Pistoia posed the question, “So what might this mean for growers when it comes to prices?”

“Let’s look at the scenario of comparing an average wheat crop on the east and a poor one on the west as the reference point (with the last 10 years’ yield average used to define what is “average” and “poor”),” he said.

“In this scenario, an average wheat crop for Victoria would be 2.6 tonne/hectare and a poor one for Western Australia 1.4 tonne/hectare, the lowest yield in that state in the last 10 years. By coincidence, the 2019/2020 season saw this scenario occur.”

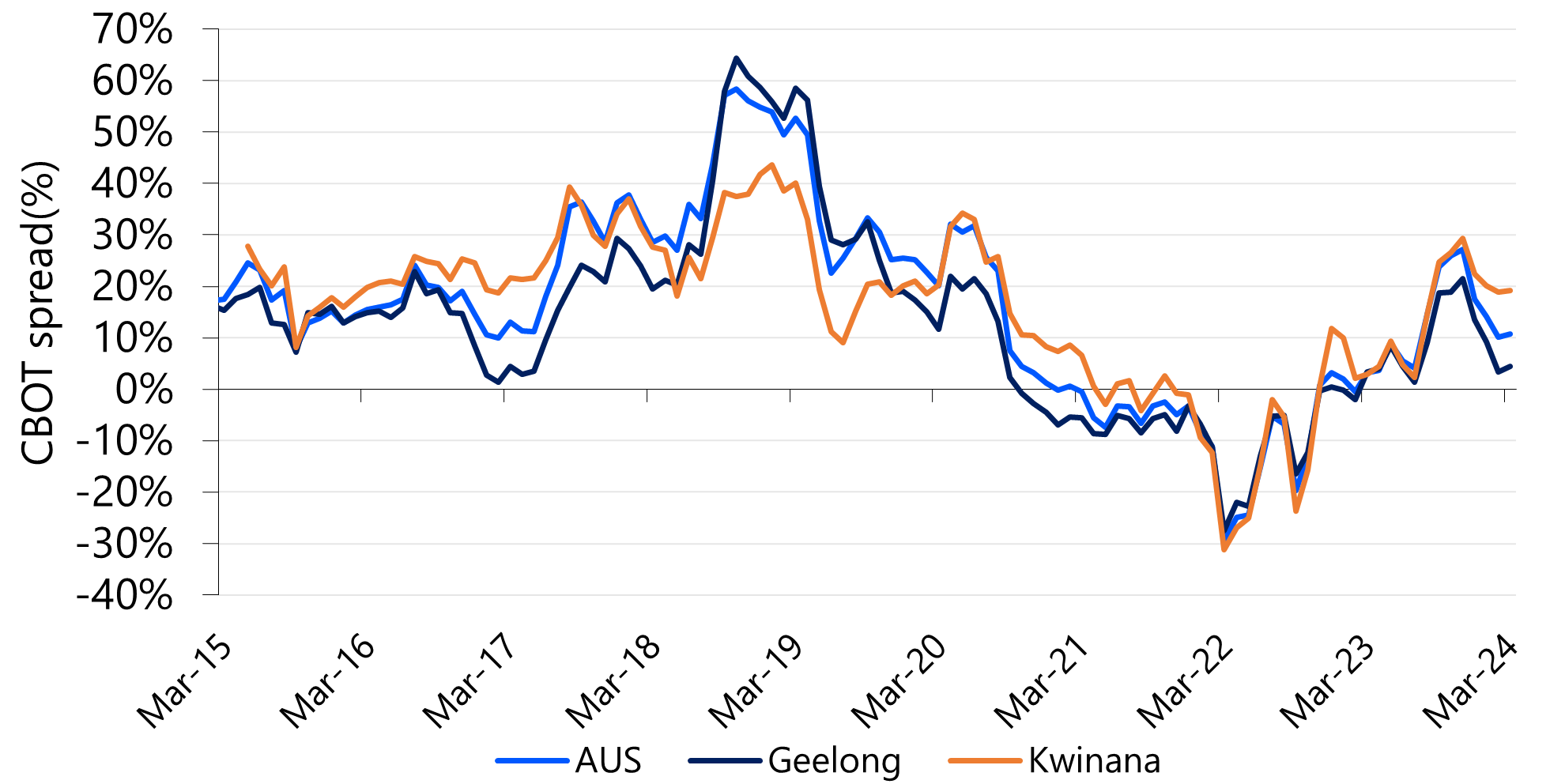

“By knowing what to look for,” Mr Pistoia said “the wheat basis chart is the ‘map to the gold’ ”.

“So in the 2019/2020 season, Australian wheat prices had an elevated basis compared to Chicago Board of Trade (CBOT) prices because of the 2018 east coast drought, which impaired national production.

“Further, in 2019, as dry weather conditions intensified in Western Australia, WA wheat basis went up even higher than the national average,” he said.

The Rabobank analyst said a similar trend has started to happen again now, in the early stages of the 2024/25 seeding period. “National wheat prices were strong before the November rains in Victoria and southern New South Wales. Since then Australia’s basis has dropped, but the needle has not moved at the same pace for everybody.

“The Kwinana port zone basis has shown more price resilience, and if WA rainfall remains insufficient, this can become more pronounced. For this scenario to come to fruition, it will inevitably mean a yield downside to support a price upside. Such is farming,” he said.

Mr Pistoia said “We are at a crossroads and the clouds will decide if we are going to have two different wheat markets or not this year in Australia”.

Figure 1. Australian average and port zones APW spread, or basis, compared to CBOT. Concentrate on the period from Mar/19 to Mar/20.

Source: Bloomberg, Rabobank 2024

To find out more about other Rabobank research, contact your local Rabobank branch on 1300 303 033 or subscribe to RaboResearch Food & Agribusiness Australia & New Zealand on your podcast app.