Farm inputs – endeavouring for a new equilibrium

Throughout 2022, the farm inputs price needle moved up, fast and often, following a series of economical and geopolitical phenomena. Rabobank analyst Vitor Pistoia said the “roll call” included COVID-19 and its subvariants, trade wars, extreme weather events and continuous supply chain disruptions.

Mr Pistoia said this two-year-long bull market for farm inputs reached its most recent peak after last European winter’s unlikely fight – now a full-scale war – around the northern shores of the Black and Azov seas. “The increasing price pressure became a raging bull market that – in the first 30 days after war broke out – led to an increase in international reference prices of nitrogen, phosphate and potash of 48 per cent, 32 per cent and 37 per cent respectively,” he said.

Driving this, Mr Pistoia said was the view among market participants that input supply availability was critical, hence stakeholders did whatever was necessary to secure fertilisers and minerals to keep factories and air seeders running.

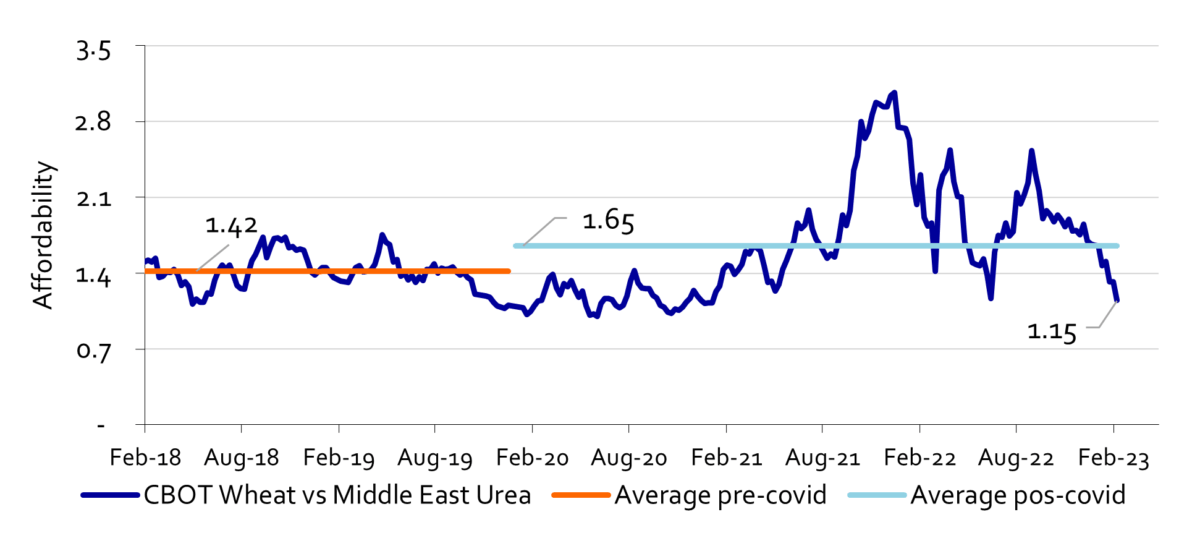

“As economic theory tells us, sudden shocks that generate imbalances are countered by a market response, which, in the context of agricultural inputs, is most commonly the application rate. As farm inputs were extremely expensive compared with historical figures (see chart) and lead times were sometimes not matching planting schedules, farmers cut fertilisers and spraying whenever possible.”

This “demand destruction” – in combination with the non-stop exportation of fertiliser from Russia and Belarus, in spite of sanctions – allowed the market to seesaw back, favouring supply by middle 2022 the Rabobank analyst said.

“And since then international prices have slowly been going down, but of course not without bumps. The energy situation in Europe has a critical impact on the production of nitrogen fertiliser, as the curtailment of nitrogen manufacturing plants in Q4 last year showed. At that point, natural gas became so expensive it was not economically viable to keep nitrogen fertiliser manufacturing operations going.”

Mr Pistoia said for now, storages are still below critical levels and the factories are back in the game.

“As fertilisers prices went up, they came down. After last year’s peak, the international reference prices for nitrogen and potash are both down by 50 per cent, and 40 per cent for phosphate.

“However local prices have not followed exactly the same pattern because supply chains are complex and, most especially, long. Besides the fact a bulk carrier takes over 30 days to reach Australia from Europe or North Africa, there is the financial component, as local prices often lag behind international movements and have price buffers factored in as well.”

Mr Pistoia said “Hopefully we might see more relief for local farm input prices as the “lag and buffer” effects work their way through the system.

“Consequently the sun is shining for 2023 Australian farmer margins as the drop in farm input prices is larger than the drop for commodities prices. And the demand for agriculture commodities is solid,” he said.

International urea affordability returns below average of CBOT Wheat per Middle East reference

Source: CRU, Bloomberg, Rabobank

Source: CRU, Bloomberg, Rabobank

The affordability index shows how many units of output are necessary to buy one unit of input

To find out more about other Rabobank research, contact your local Rabobank branch on 1300 303 033 or subscribe to RaboResearch Food & Agribusiness Australia & New Zealand on your podcast app..